What is UBL? Everything about the format behind e-invoicing

E-invoicing is accelerating fast. As an entrepreneur, you’re probably hearing more and more terms like UBL invoices, Peppol and structured electronic invoices. At the same time, you’re told that e-invoicing will soon be mandatory. But what does that actually mean for you?

Good news: you don’t need to be a tech expert to keep up. In this article, we’ll explain in simple terms what UBL is, why it matters so much for e-invoicing, and how you can already prepare for tomorrow’s rules - starting today. 😁

- E-invoicing: why everyone talks about UBL and Peppol

- What is a UBL invoice?

- Universal Business Language in plain English

- PDF invoice vs UBL invoice: what's the difference?

- What's inside a UBL file?

- Why does UBL exist?

- One unified format across the EU

- Less manual work, fewer errors

- Automatic recognition in accounting software

- What does a UBL invoice look like?

- What is Peppol?

- A secure network for document exchange

- Not a format but a transport system

- UBL vs Peppol: the difference

- Why UBL and Peppol matter for your business

- How do you create a UBL invoice?

- How do you send UBL invoices via Peppol?

- Common misconceptions about UBL and e-invoicing

- When will UBL invoices become mandatory?

- UBL and Peppol in practice: what do you need?

- Our tip for starters: start smart, not complex

- Bonus tip: 20% lifetime discount on B2Brouter

TL;DR

UBL stands for Universal Business Language, a standard format for electronic invoices.

A UBL invoice is an XML file with all invoice details (customer, totals, VAT, due date…) in fixed, structured fields.

Thanks to UBL, accounting software can automatically read and process invoices; no retyping required.

Peppol is not an invoice format, but a secure network used to exchange documents such as UBL invoices.

As of 1 January 2026, structured electronic B2B invoices will become the norm for Belgian VAT-liable businesses.

With the right e-invoicing software, you’re compliant instantly.

Via B2Brouter (available through Combell) you can create and send UBL invoices via Peppol with 20% lifetime discount as a Combell customer.

E-invoicing: why everyone talks about UBL and Peppol

Governments across Europe are heavily pushing e-invoicing. In Belgium, electronic B2B invoicing will become the standard for almost all VAT-liable companies. In practice: paper and PDF invoices are being replaced by structured e-invoices that flow directly from one software system to another.

Two key building blocks make this possible:

Understand these two, and you understand the basics of modern e-invoicing. 😉

As a (small) business owner, you want efficiency and compliance

If you’re just starting out or running a small company, you don’t have time to dive into technical standards. You simply want to:

The good news: you don’t need to implement UBL or Peppol yourself. Good e-invoicing software handles all of it in the background. Still, understanding the basics helps you make smart choices.

Tip

Are you about to start your own business? Then this blog post is full of tips you can use to start working as a self-employed person. Good luck!

What is a UBL invoice?

Universal Business Language in plain English

UBL stands for Universal Business Language: an international standard language for business documents such as invoices, purchase orders and delivery notes.

In practice:

Think of UBL as the grammar all software uses to understand each other.

PDF invoice vs UBL invoice: what's the difference?

A classic PDF invoice is actually a kind of image of your invoice. As a human being, you can read it perfectly, but software has difficulty with it. That is why you or your accountant often have to manually retype the data.

A UBL invoice, on the other hand, is pure data. You don't see the invoice as a nice document, but as structured information. This has major advantages:

In practice, you often send both:

What's inside a UBL file?

A UBL invoice typically includes:

All this information is contained in clearly labelled fields. This means your accounting software knows exactly where to find the amount excluding VAT, the VAT amount and the total.

Why does UBL exist?

One unified format across the EU

Without a standard format, each supplier sends invoices in a different model. This is very difficult for computers. UBL provides a single uniform method for transmitting data, enabling software from different suppliers to communicate smoothly with each other.

Within the EU, UBL complies with the EN 16931 standard for e-invoicing. This makes it easier for countries and systems to work together.

Less manual work, fewer errors

UBL makes automated processing possible:

Everyone wins: you, your accountant and your customers.

Automatic recognition in accounting software

Most modern accounting packages can directly import UBL files. This is often done as follows:

- Your customer receives the UBL invoice.

- Their software imports it automatically.

- All amounts and VAT rules are correctly identified.

Result: faster approval and faster payment.

What does a UBL invoice look like?

Simple XML structure

This is a simplified example of what a UBL invoice looks like behind the scenes:

<Invoice>

<ID>2025-00123</ID>

<IssueDate>2025-03-15</IssueDate>

<AccountingSupplierParty>

<Name>Your Company Ltd</Name>

<CompanyID>BE0123456789</CompanyID>

</AccountingSupplierParty>

<AccountingCustomerParty>

<Name>Client NV</Name>

<CompanyID>BE9876543210</CompanyID>

</AccountingCustomerParty>

<LegalMonetaryTotal>

<TaxExclusiveAmount>100.00</TaxExclusiveAmount>

<TaxInclusiveAmount>121.00</TaxInclusiveAmount>

</LegalMonetaryTotal>

</Invoice>

Real UBL structures are more extensive, but the principle is identical: every element has its own defined field.

Why you usually never see these files

If you use e-invoicing software, you will rarely or never see such XML code. You simply fill in your invoice as usual, and the software automatically converts it into a correct UBL invoice that your customer can process.

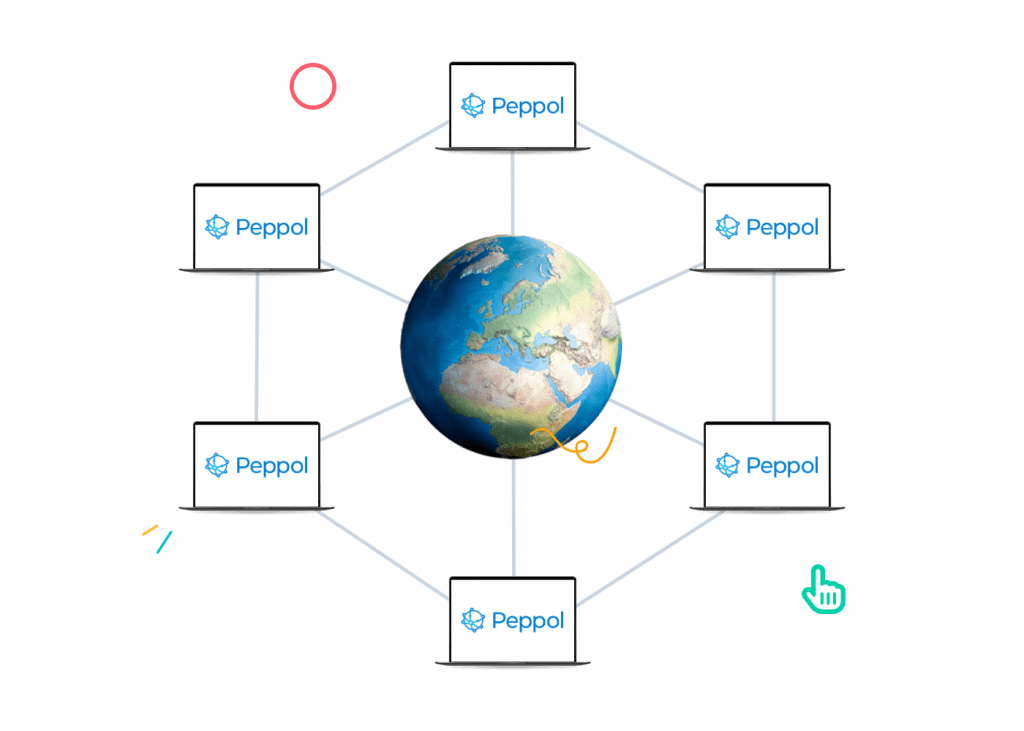

What is Peppol?

A secure network for document exchange

Peppol is an international network for the secure exchange of electronic documents, including invoices.

Think of it like the mobile phone network:

So you don't need to know which software or provider your customer uses. The Peppol network ensures that your invoice automatically ends up in the right place.

‘Is Peppol completely free, or not?’ you may be wondering. In this article on our blog, we give you all the answers.

Not a format but a transport system

Important to remember:

Peppol does not determine the content of your invoice, but it does determine how it gets from A to B securely.

UBL vs Peppol: the difference

People sometimes say “Peppol invoice”, but that’s not correct:

Think of UBL as the car, and Peppol as the road it drives on.

Why UBL and Peppol matter for your business

In Belgium, structured e-invoicing is becoming mandatory step by step:

Across the EU, e-invoicing is also becoming the default. Starting with UBL and Peppol now means you’re building future-proof processes.

No more manual entry, fewer mistakes

Especially for small businesses, the impact is huge:

Faster payments and better cash flow (cash, cash!)

Because invoices land directly in your customer’s accounting system, they’re processed faster:

Good news for your cash flow.

How do you create a UBL invoice?

The easiest way to create UBL invoices is via e-invoicing software:

This means you don't have to write any XML code or know any technical settings.

Build your own UBL/XML? No thank you!

Technically possible, but:

For start-ups and SMEs, this is simply not a good investment. You will save a lot of time and frustration by choosing an existing solution.

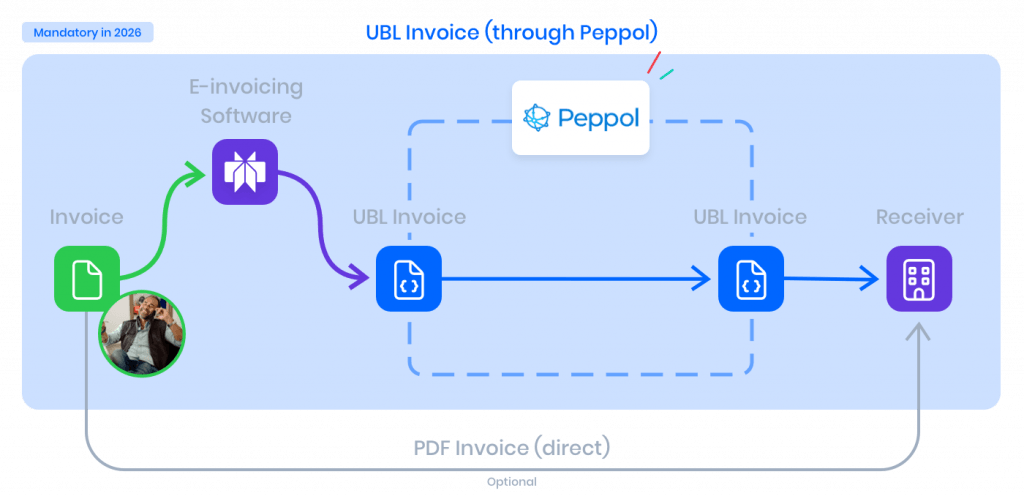

How do you send UBL invoices via Peppol?

Step-by-step guide for beginners

In practice, sending UBL invoices via Peppol looks something like this:

- Select an e-invoicing solution that supports Peppol (such as B2Brouter from Combell).

- Create your account and enter your company details (VAT number, address, bank account, etc.).

- You will be connected to the Peppol network via your software.

- Create a new invoice as you normally would.

- In the software, select to send via Peppol.

- The software will automatically convert your invoice into a correct UBL invoice and send it to your customer via Peppol.

Your first UBL invoice

Imagine: you are a freelance copywriter and you invoice a Belgian company.

For you, little will change in the way you create invoices. For your customer and for the government, the difference is enormous.

Common misconceptions about UBL and e-invoicing

“UBL is the same as Peppol”

UBL and Peppol are often mentioned in the same breath, but they are not the same thing:

You often need both, but they fulfil different roles.

“A PDF by email is fine”

Today, many customers still accept PDF invoices. However, under the new rules, a structured e-invoice will become the only legally compliant invoice between Belgian VAT-registered companies.

A PDF can still be sent as a copy, but the UBL invoice is what counts.

“E-invoicing is only for large companies”

The obligation also applies to small businesses and start-ups. Fortunately, you do not need to set up your own IT project:

When will UBL invoices become mandatory?

For Belgian businesses:

The key date: 1 January 2026. From then on:

You still have time to prepare, but the sooner you start, the less stress you will have in 2026.

European obligations too

The EU is also promoting e-invoicing through various initiatives. By working with UBL and Peppol now, you are choosing a solution that is compatible across borders. This is useful if you plan to work with foreign customers in the future.

UBL and Peppol in practice: what do you need?

Choose e-invoicing software

Your tool should:

Connect with your accounting system

Ideally, you should link your e-invoicing software to your accounting package:

Connect to Peppol

Many solutions arrange the connection to Peppol for you. This means you do not have to build any technical integration yourself. Often, all you need to do is confirm your company details and you are ready to send and receive invoices.

Our tip for starters: start smart, not complex

As a start-up or small SME, it is tempting to stick with PDF invoices “for the time being”. However, it is often smarter to take the plunge now:

Choose a solution that is easy to launch, so you don't have to manage an IT project. Let UBL and Peppol work behind the scenes without any hassle.

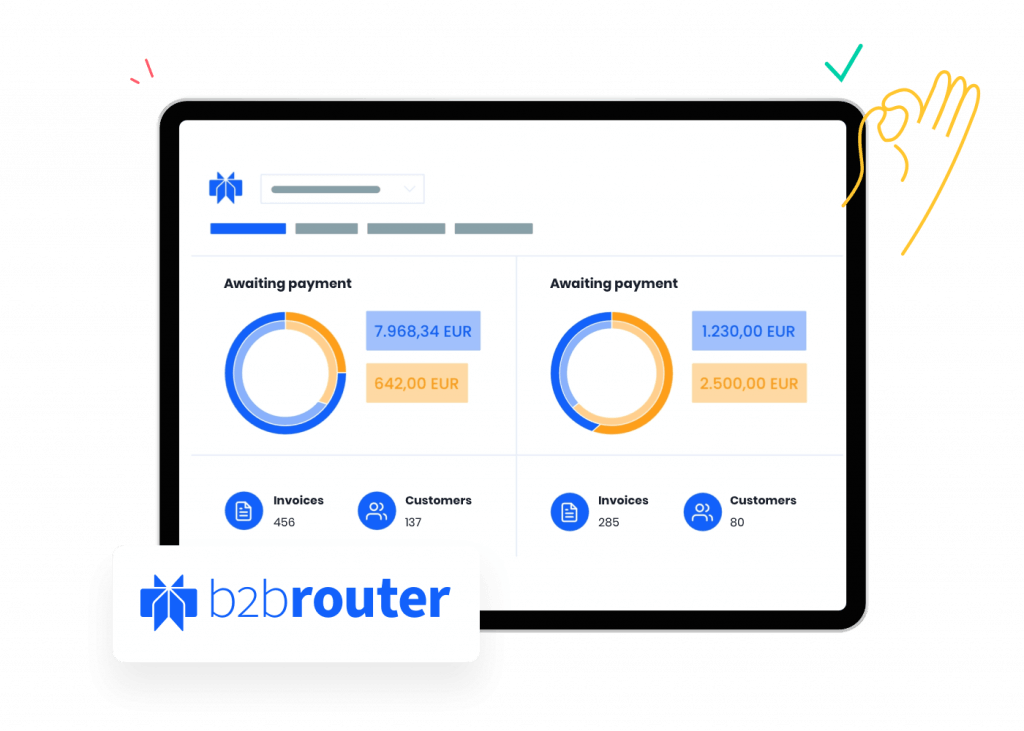

Bonus tip: 20% lifetime discount on B2Brouter

Want to start with UBL and Peppol without the hassle?

With B2Brouter via Combell:

As a Combell customer, you get a 20% lifetime discount on your B2Brouter subscription. You can even start for free, perfect for testing everything at your own pace.

Activate your B2Brouter account via Combell, discover how easy e-invoicing with UBL and Peppol can be, and get your business ready for 2026 today, with a 20% lifetime discount.