Accountant or bookkeeping firm? Help your clients e-invoice smarter with B2Brouter

From 1 January 2026, e-invoicing via Peppol becomes mandatory for B2B in Belgium. Good news for efficiency, but it does require preparation: your clients will expect your accounting firm to guide them toward Peppol compliance with minimal impact on their day-to-day operations. B2Brouter from Combell ensures less manual follow-up, fewer errors and faster payments thanks to correct delivery.

- Help your clients move towards e-invoicing

- Manage the peak efficiently with B2Brouter

- Benefits for your clients (and why they'll be grateful 😉)

- E-invoicing: what changes for accountants?

- What you need to know about e-invoicing:

- PDFs are no longer sufficient

- Checklist: make your firm Peppol-proof

- Concrete: what is B2Brouter and how does it work?

- Why B2Brouter is interesting for accountants and bookkeeping firms

- One central hub for e-invoices (multiclient)

- Easy connection to multiple accounting tools

- More efficient processing and less manual work

- Better error checks and automatic validation

- Faster payments through correct delivery

- 100% compliant with Peppol standards

- Using B2Brouter smartly for your clients and within your own firm

- 1️⃣ Clients without their own invoicing software

- 2️⃣ Small independents & non-profits

- 3️⃣ Testing and onboarding tool before ERP migration

- 4️⃣ Peppol gateway for your own software

- 5️⃣ Multiclient management with dossier-based permissions

- 6️⃣ Bulk processing and status tracking

- 7️⃣ Reassure uncertain clients

- Peppol & B2Brouter: step-by-step integration

- Practical: how to get started as an accountant?

- E-invoicing is not a burden but an opportunity!

TL;DR

From 2026 onwards, e-invoicing via Peppol becomes the norm for B2B in Belgium. Accountants in Flanders can already prepare with B2Brouter: one central tool to send/receive e-invoices, validate them automatically, follow statuses and manage clients in a multiclient setup. Start for free and activate 20% lifetime discount via Combell.

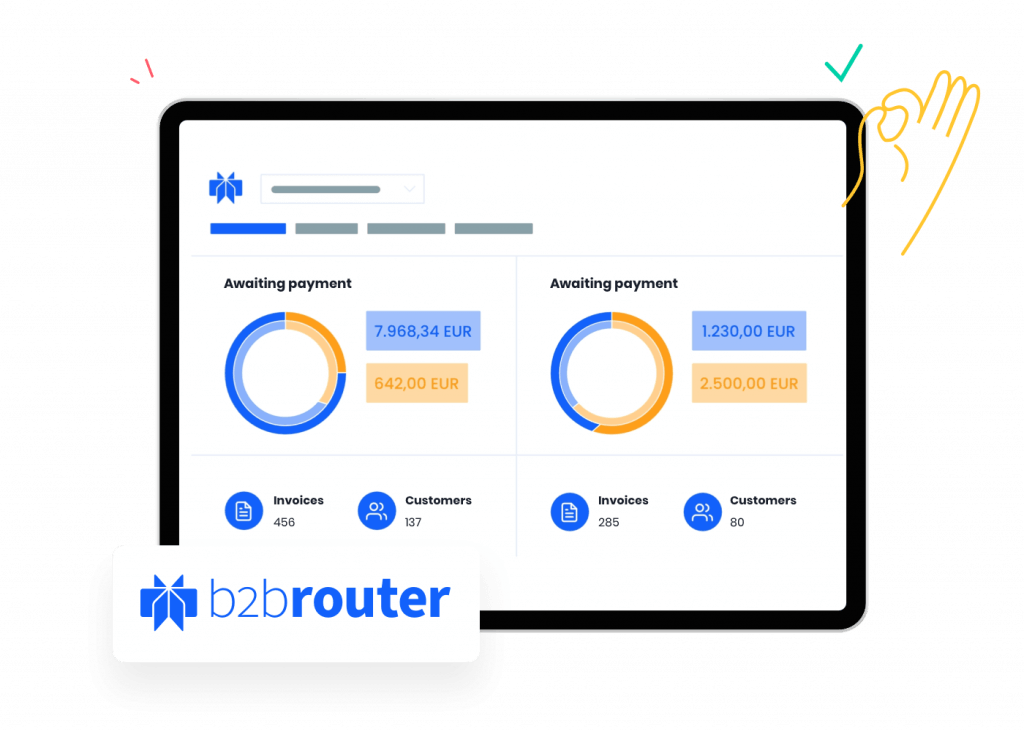

B2Brouter is a central Peppol hub for sending and receiving e-invoices with automatic EN-16931 validation, clear status updates (delivered, rejected, resent…) and multiclient management.

Use it standalone for independents and non-profits without their own tools, or as a gateway between your trusted software (such as Odoo) and the Peppol network. You start for free and, as a Combell customer, enjoy 20% lifetime discount.

In this blog we show how to set this up step by step as an accountant or firm, and how you can already make a difference today.

Help your clients move towards e-invoicing

Do you have your own accounting firm, do you work for one, or are you self-employed? You would do well to prepare thoroughly for e-invoicing.

Soon, customers will be bombarding you with questions: ‘How do I set up Peppol? Which fields are mandatory? Why is an invoice being returned?’ Without preparation, you risk drowning in work and having to put out a lot of fires. So map out your customer base (who already has software, who doesn't?), choose an approach for each segment (stand-alone or gateway), establish validation rules and, if necessary, agree on internal SLAs and escalations.

Also provide training materials and a short starter guide so that your team doesn't have to deal with frequently asked questions over and over again.

Manage the peak efficiently with B2Brouter

You get one multiclient tool with roles and permissions, templates, bulk processing and automatic EN-16931 validation. Does a client already work with accounting software like Odoo? Use B2Brouter as a gateway: your team stays in familiar tools, B2Brouter handles Peppol routing, logs and status messages.

This reduces ticket volume and prevents bounced invoices. Clients immediately see their invoice status and pay faster thanks to correct delivery. You can start for free and, as a Combell customer, enjoy a 20% lifetime discount. An investment that quickly pays off through fewer errors, less follow-up and more peace of mind within your team.

The biggest mistake accounting firms can make now is to wait until 2026. By then, clients will be asking for help en masse. With B2Brouter, you can handle that peak in a structured way: one cockpit, automatic validations and clear statuses, fewer fires to put out, more control.

Tim Barker, Group Head of Cross-Sales, team.blue

Benefits for your clients (and why they'll be grateful 😉)

E-invoicing: what changes for accountants?

From 1 January 2026, all Belgian VAT-liable companies must use structured electronic invoices (EN 16931) for B2B transactions and exchange them securely (via Peppol, among others). PDFs or paper invoices no longer suffice. For B2C, nothing changes. This reform accelerates digitalisation, reduces VAT fraud and improves data consistency.

As mentioned, many clients will look to their accountant or bookkeeping firm for guidance.

Also read

Want to advise your customers even better? Read our article and find out everything you need to know about Peppol.

What you need to know about e-invoicing:

PDFs are no longer sufficient

Manual invoicing, sending invoices by email, PDF attachments… they all lead to errors, delays and poor cashflow insight.

E-invoicing brings structure, traceability and faster payments because invoices are delivered correctly and on time. You and your clients have a lot to gain.

Also read

Many accountants are asked: ‘Is Peppol actually free?’ We wrote a clear explanation about this, including what does and does not cost to connect.

Checklist: make your firm Peppol-proof

- Decide per client: stand-alone or gateway

- Check VAT numbers, IBAN, references and address details

- Activate EN-16931 validations and mandatory fields

- Test with a small batch and review status logs

- Connect your systems via API/SFTP/connector

- Automate exception notifications

- Document your workflow and train your team

- Communicate with customers by providing a starter guide and training session.

- Monitor volumes and lead times; adjust based on reporting

- Start free with B2Brouter and…

- …claim your 20% discount via Combell and plan your rollout.

Concrete: what is B2Brouter and how does it work?

B2Brouter is an easy-to-use e-invoicing tool with a certified Peppol Access Point. You send and receive e-invoices following EN 16931, with automatic validation, status messages and API/SFTP/connector integrations to your software.

It is ISO 27001-certified and suitable as a standalone tool or as a bridge between your systems and the Peppol network.

Difference with classic invoicing software:

Standalone or gateway

Why B2Brouter is interesting for accountants and bookkeeping firms

One central hub for e-invoices (multiclient)

Manage all clients in one environment. Switch effortlessly between dossiers and follow volumes, statuses and exceptions. Ideal for small and medium-sized firms aiming to scale.

Accountants want to continue working with their familiar tools. That is why many firms use B2Brouter as a gateway to Peppol: you retain your existing processes, while routing, logging and EN 16931 checks are managed centrally.

Tim Barker, Group Head of Cross-Sales, team.blue

Easy connection to multiple accounting tools

Work with different systems? With APIs, SFTP and other integrations, you connect flexibly. Avoid vendor lock-in and keep options open.

More efficient processing and less manual work

Automatic validation and status updates prevent faulty invoices and manual rework. Bulk features speed up repetitive tasks. Result: more time for advice and client contact.

Better error checks and automatic validation

B2Brouter verifies mandatory fields (VAT numbers, IBAN, amounts, references…) and formatting rules. Deviations are detected early so invoices don’t get stuck along the way.

Faster payments through correct delivery

Correctly validated invoices are delivered without friction to the right recipient. That reduces discussion and speeds up payment terms.

100% compliant with Peppol standards

By using a certified Access Point with EN 16931 validation, your firm operates by the rules—today and tomorrow.

Using B2Brouter smartly for your clients and within your own firm

1️⃣ Clients without their own invoicing software

Self-employed workers, independent professionals and non-profits may not have a full invoicing tool. Let them start free in B2Brouter and manage their e-invoicing. You gain oversight, they become Peppol-proof without major investment.

2️⃣ Small independents & non-profits

Create templates for recurring clients (subscriptions, donations, memberships). Use bulk sending and status tracking to handle peak periods (e.g. quarterly invoices).

3️⃣ Testing and onboarding tool before ERP migration

Are clients preparing to switch to an ERP? Let them test the Peppol flow first via B2Brouter. That improves data quality and process clarity before going live.

4️⃣ Peppol gateway for your own software

Use B2Brouter as a gateway: let your current software export UBL/Peppol or mapped formats and send/receive via B2Brouter. You keep your frontend, B2Brouter handles routing, validation and logs.

5️⃣ Multiclient management with dossier-based permissions

Assign roles and permissions per client. Grant read-only or self-service access while retaining control.

6️⃣ Bulk processing and status tracking

Process large volumes in one go and monitor in real time whether invoices are delivered/accepted. Enable notifications for exceptions so you can act proactively.

7️⃣ Reassure uncertain clients

Many clients will (slightly) panic once they realise they’re not ready for e-invoicing. Recommend B2Brouter for a smooth and reassuring transition to Peppol invoicing. Let the calls come!

Peppol & B2Brouter: step-by-step integration

- Inventory: map per client the system, data quality and invoice volumes

- Segmentation: choose standalone (small clients) or gateway (clients with their own tools)

- Validation rules: activate EN-16931 checks and test pilot dossiers

- Connecting: configure API/SFTP, define mappings and run a test batch

- Go-live: set up monitoring and exception alerts

- Follow-up: document the flow and schedule periodic reviews

E-invoicing should not be a burden. With B2Brouter, customers can immediately see the status, invoices are returned less often and payment terms are shortened. And with Combell, getting started is free, with a fixed 20% discount afterwards.

Tim Barker, Group Head of Cross-Sales, team.blue

Practical: how to get started as an accountant?

Free to start and test

Let clients start for free and quickly see whether standalone or gateway fits. Avoid major upfront costs.

Documentation and support

You can rely on documentation and support from Combell (hosting and integration) as well as B2Brouter (the tool itself). Need advice? Our experts are ready to help.

Start free and claim 20% lifetime discount!

As a Combell customer, you start for free and later enjoy a 20% lifetime discount on B2Brouter plans. Combined with time savings and fewer errors, it’s clear why this is the ideal tool for your firm.

E-invoicing is not a burden but an opportunity!

E-invoicing isn’t an administrative burden; it’s an opportunity to modernise your firm and improve your service and advice.

With B2Brouter, you have a central Peppol hub for multiclient management, validation and status tracking, with flexible integrations into the tools you already use. Don’t wait: get started now and make an immediate difference for your clients. Whether through our support or via this blog… Good advice is free at Combell. 😁

and activate your 20% lifetime discount later on.