Webshop payment systems: exploring the possibilities

Anyone starting out with a webshop may fear most the handling of online payments. The only thing you need to see your money through your online store is a payment provider, which enables various payment methods.

But since there is quite a jungle of online payment methods, we like to go over the most convenient ones. Because starting a webshop also means choosing a payment method you feel most comfortable with.

- What online payment methods are there? An overview

- Cash payment

- Bank transfer

- After-sales payment

- PayPal

- Bancontact, Payconiq and iDeal: the QR code

- Credit cards

- Crypto coins

- Online payment methods via Payment Service Providers

- Ready to get started?

- Frequently asked questions about online payment methods

But one tip: don't pin yourself down to one method of (online) payment: start looking at what other payment methods can do for you. Because often an extra payment method means more sales!

Don't worry about having to build your own payment system: there are plenty of plug-ins for WordPress web shops, and our own SiteBuilder (a shop builder with web shop module) can easily be linked to the most popular payment providers.

There is a distinction between online payment methods and online payment providers. Payment methods define how you pay (cash, bank transfer, Bancontact, Sofort Banking ...), while payment providers (such as Mollie, Stripe, MultiSafePay ...) process the payments. To offer most payment methods on your webshop, you need a payment provider.

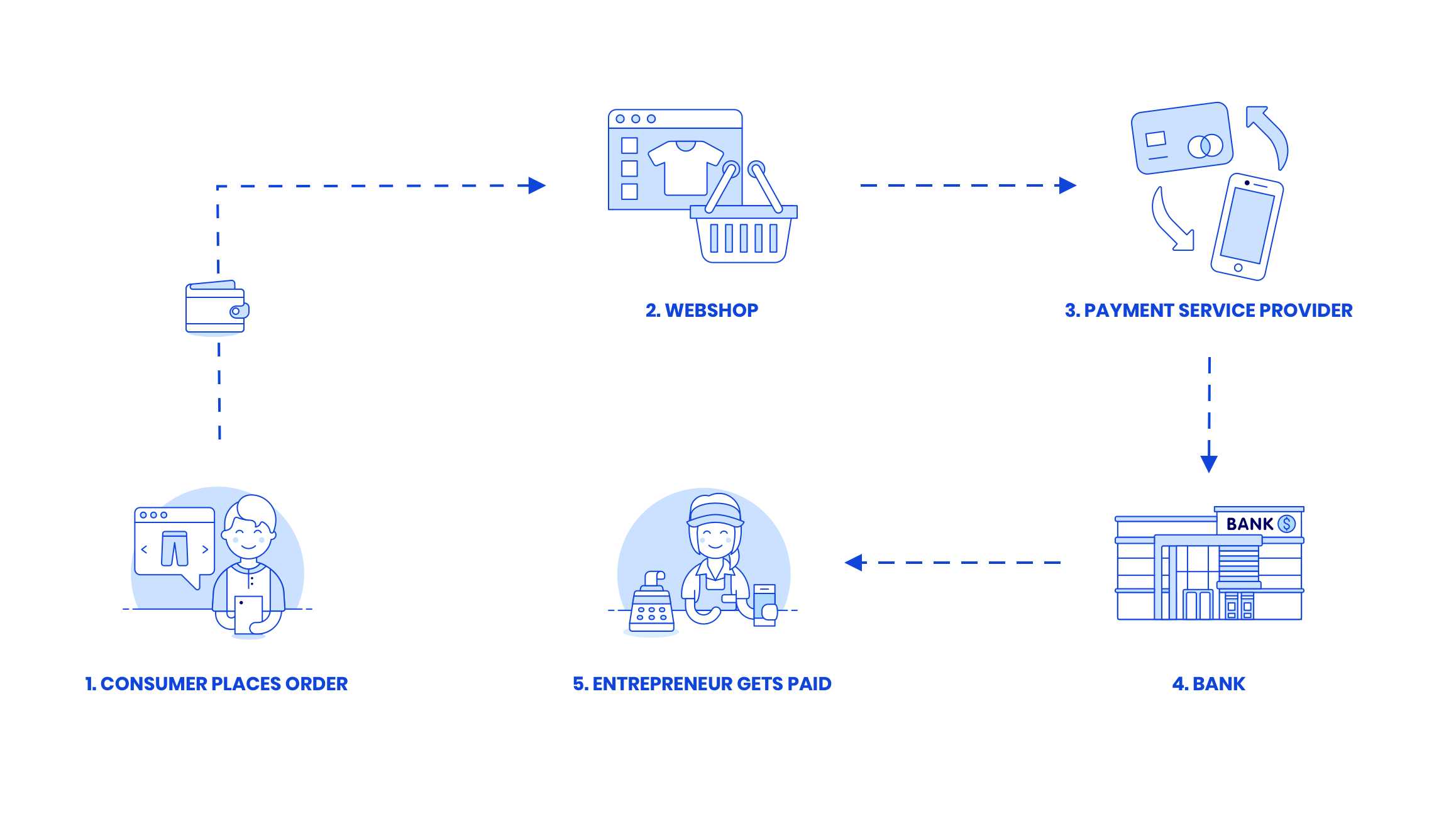

It is also important to know that your webshop itself does not keep money: it is indeed necessary to link an external payment method to your webshop. That way, the customer pays directly into your account.

With Combell, you can create a web store without much effort or technical knowledge. Curious about how easy it is? Discover the possibilities of building a professional web store.

What online payment methods are there? An overview

In an ideal world, there was one online payment method that everyone used. But unfortunately, every customer has their own preferences about how they prefer to pay.

So we list the most popular payment methods. How to implement them on your webshop (with a payment provider), we'll check that out later!

Cash payment

When you sell products and make your own deliveries of online purchases, or ask your customers to pick up their order from your online store at your physical store, you can opt for cash payment.

This is obviously the simplest way: your customer pays immediately when he or she is handed the order.

Bank transfer

You can also offer the classic bank transfer as a payment method for an online purchase. The customer leaves an e-mail address and you provide an e-mail to the customer after the order with the payment details.

This does mean a little more work for you: you have to keep a closer eye on your bank account in order to be able to send all orders when you have received their payment.

After-sales payment

Few retailers like to choose this option, but in the Netherlands, for example, it is mandatory to offer "pay afterwards" as a payment option.

This method allows your customer to pay for your products after the fact, from the moment he/she received the order, and decided to keep it. This way, a consumer never pays for what he returns.

After-sales payment - on invoice

The "payment by invoice" is a way that is quite normal for physical stores, but webshops do not use it as much. Unless you start a B2B webshop.

When you do opt for it, the customer is sent an invoice along with his order, stating a payment period, within which that customer then pays afterwards.

But beware: if you handle the retrospective payments yourself, you also have to go after defaulters yourself.

Pay afterwards - with a payment tool

As mentioned above, it is inconvenient when a customer does not pay (on time). Therefore, you can choose a partner that manages your invoicing for you. When you work with such a (paying) tool, you are insured against defaulters.

For example, you can work with Klarna AfterPay: a payment tool that guarantees your payment regardless of whether they have already received your customer's payment (for €1 + 2.99% of the transaction, admittedly).

The KBC payment button also ensures that you get your money (for 1% of the transaction, and only if you have a business account with KBC). AfterPay is another popular tool for paying afterwards.

Cash on delivery

Another way for your customer to pay in arrears is to pay cash on delivery. This means that your customer only pays the parcel deliveryman when he hands over the parcel at the delivery address (or when your customer picks it up at a pickup point).

Most parcel services offer a "cash on delivery" option.

PayPal

PayPal is an online payment method that works as an "online wallet": a user links their bank or credit card to a PayPal account, making it easier to pay online. We do not recommend using PayPal, as its security and support do not always appear to be optimal.

Bancontact, Payconiq and iDeal: the QR code

Just as you pay with your bank card in a physical store, you can also pay with Bancontact (for webshop). This is a payment method where your customers make an immediate payment through their own bank.

In 2020, 43% of online payments were made via Bancontact.

On the one hand, this can be made using a 'home banking machine', but with Payconiq, your customer can also scan a QR code with his smartphone, or open the payment in the app - this takes your customer straight to the payment screen in the online banking environment of your own bank.

If you have Dutch customers, you should also provide the option to pay via iDeal - the Dutch brother of Bancontact, for webshop.

Credit cards

Of course, customers often like to pay by credit card: in 2020, one-fourth of consumers paid online by credit card, with Mastercard and Visa being the most widely used credit cards.

Not surprisingly, credit cards are popular: this way, a consumer only "really" pays at the end of the month, and his purchased product is sometimes additionally insured by the credit card company.

AND you also reach international consumers with it: VISA alone has more than 1.1 billion cards in circulation worldwide. That's a lot of customers!

Crypto coins

As a retailer, if you are somewhat adventurous, you can also opt for payment in Bitcoin or other crypto currencies. Bitcoin transaction fees are lower than other payment methods, and you can receive online payments from all over the world.

But of course, the value of Bitcoin is very fluctuating, and it still requires you to have some knowledge to keep up with the whole blockchain story.

Furthermore, the question remains as to whether it is really worth the effort, considering that there are only a few people who want to pay with Bitcoins or any other cryptocurrency. That is why very few online merchants have opted for Bitcoin – as you can see here.

Online payment methods via Payment Service Providers

Having learned which ways your customer can pay, it's time to take a closer look at the payment providers that enable these methods on your webshop.

You use a payment provider to avoid having to install a plug-in or enter into a separate contract for each payment method separately. In other words, payment providers take care of bundling all payment methods.

As a Belgian retailer, you can choose from about 20 payment providers, who offer an assortment of payment options on one platform. This way, a consumer can easily pay via different ways through a spectrum of online payment methods.

The most popular payment providers in Belgium include Mollie, Stripe, Adyen or MultiSafePay. We will take a look at Mollie and Stripe below - two secure, reliable payment providers. Other popular providers operate similarly.

By the way, all these payment providers can be effortlessly linked to Combell's web store builder.

Mollie

Mollie is a Dutch payment provider, and one of the most popular choices in Belgium and the Netherlands. Mollie allows online payments to be made securely through an extensive range of payment methods, and charges no startup or monthly fees: you only pay when a customer makes an online payment.

For a payment with Bancontact, Mollie charges €0.39, for (non-business European) credit cards such as Visa, MasterCard or American Express you pay €0.25 + 1.8% per transaction.

Stripe

Stripe is a widely used payment service provider that has been available in the Benelux since 4 years, and also has large companies such as Facebook or Salesforce as customers.

There is a (sufficiently usable) free version of Stripe, but if you want something more personalized or want the platform completely customized, you do pay a bit more.

For a payment with Bancontact you pay €0.25 + 1.4% of the transaction, just like for payments with (European) credit cards.

Bank payment providers

Your bank may also have a tool that bundles different payment methods. For example, there is KBC PayPage for store owners with a KBC business account - but beware, as you will have to pay a start-up fee. So be sure to check with your bank what the options are!

Ready to get started?

The e-commerce payments on webshops are perhaps the biggest barrier to starting your own webshop. But do not be discouraged: the payment providers we have mentioned are to be trusted.

You will always end up paying a small part of your revenue to your payment provider, but that does not outweigh the great convenience and the potential new consumers you reach with a webshop!

By the way, you do not need any technical knowledge: with Combell's SiteBuilder, you can, for instance, build a webshop - with payment methods - without any computer knowledge!

Ready to start your webshop? Then, be sure to check out the possibilities with Combell!